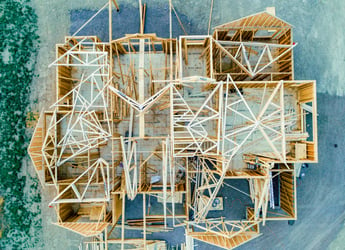

Construction and renovation lending is a high-stakes business. With rising costs, tighter timelines, and increasing scrutiny, lenders face mounting pressure to ensure their loans are backed by feasible, well-documented projects. One misstep, whether it’s a flawed budget, a misaligned scope, or a contract that conflicts with best practices, can lead to delays, cost overruns, over-disbursements, and even loan defaults.

That’s why Trinity is proud to introduce three enhanced services designed to help lenders proactively prevent construction loan failures: Project Review, Project Review - Prestart, and Project Review - Renovation. These services provide a comprehensive framework for evaluating the full picture construction and renovation projects before the loan closing, mitigating risk, improving loan performance, and building a stronger foundation resulting in faster draws.

Project Review: Strengthening the Financial Foundation

Every successful construction loan begins with a solid budget. Trinity’s Project Review service ensures that the proposed budget is complete, realistic, and aligned with market standards. Too often, lenders approve loans based on budgets that are either incomplete, deficient or inflated, leading to budget shortfalls, stalled progress, potential fraud and increased risk of default.

Trinity’s Project Review process includes a detailed analysis of all budget line items, from materials and labor to permits and contingency reserves. Each component is evaluated for accuracy and rated as low, acceptable, or high risk. Missing or inflated costs are flagged, giving lenders a clear view of potential vulnerabilities.

But the service goes beyond budget sufficiency. Trinity also reviews the alignment between the budget, construction contract, project plans, specifications, and appraisal details. Discrepancies in these areas can lead to miscalculations in loan amounts and unrealistic funding expectations. For example, if the contract requires an $80,000 deposit on a $400,000 project, then the project is already over-disbursed at closing. Trinity ensures all documentation aligns with best practices, reducing the likelihood of disputes, budget shortfalls, and delays.

This service also lays the groundwork for accurate draw inspections. By confirming that the budget is feasible and comprehensive, inspectors know what they are inspecting and lenders can better track progress and disburse funds with confidence throughout the construction lifecycle.

Why These Services Matter

Construction lending is inherently complex. Projects are subject to market fluctuations, regulatory hurdles, and countless variables that can impact cost, timeline, and accurate disbursements. For lenders, this means navigating a landscape filled with uncertainty, while protecting their capital and maintaining borrower relationships.

Trinity’s enhanced services are designed to bring clarity and confidence to this process. By offering detailed budget validation, early-stage inspections, and holistic feasibility assessments, Trinity helps lenders identify and mitigate risks before they become problems. This proactive approach leads to better loan performance, fewer defaults, and more successful project outcomes.

These services are also scalable and adaptable. Whether you’re financing a minor renovation or a full-scale development, Trinity’s tools can be tailored to fit the size and complexity of the project. They’re designed to support lenders at every stage of the construction loan lifecycle, from initial underwriting to final disbursement.

In addition to reducing risk, Trinity’s services enhance transparency and communication. Lenders gain access to clear, actionable insights that help them make informed decisions. Borrowers benefit from a more structured and predictable loan process. And contractors appreciate the clarity and consistency that comes from working with well-defined budgets and expectations.

Trinity’s services also integrate seamlessly with draw inspections, ensuring that each disbursement is backed by verified progress and aligned with the approved scope. This reduces the risk of overfunding, improves accountability, and strengthens the overall integrity of the loan.

Conclusion: Building Smarter, Lending Safer

Trinity’s refresh of Project Review, Project Review - Prestart, and Project Feasibility marks a significant advancement in construction loan risk management. These services provide lenders with the tools they need to evaluate projects thoroughly, identify potential pitfalls, and structure loans that are built for success.

In a market where construction challenges are growing more complex, Trinity offers a smarter way to lend. By focusing on accuracy, alignment, and feasibility, and by supporting every phase of the loan with reliable draw inspections, Trinity helps ensure that every project starts and finishes strong.

Trinity’s Project Review services are available to lenders nationwide. Whether you’re looking to improve loan performance, reduce risk, or gain greater confidence in your construction portfolio, Trinity is here to guide you through the complexities.